boulder co sales tax efile

The Citys current sales tax rate for sales within the City of Cortez is 405. Please send a copy of your sales tax return along with your payment for city sales and use taxes to City of Edgewater.

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Filing frequency is determined by the amount of sales tax collected monthly.

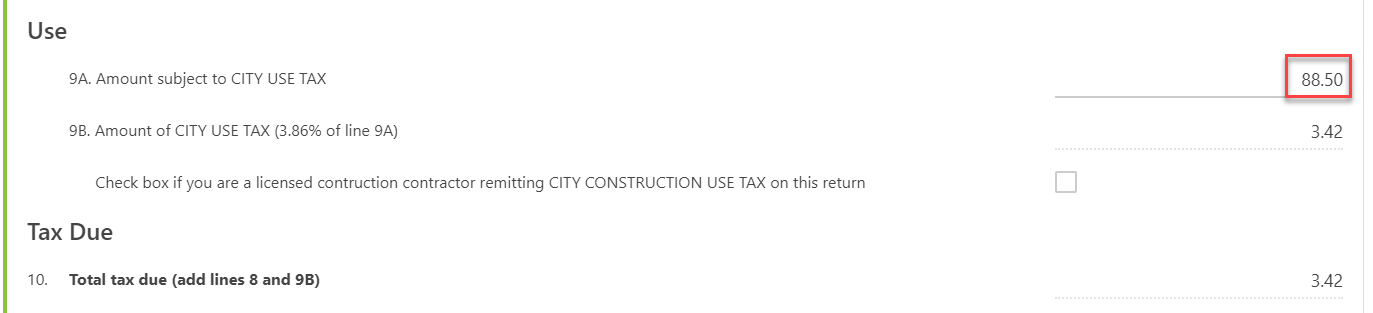

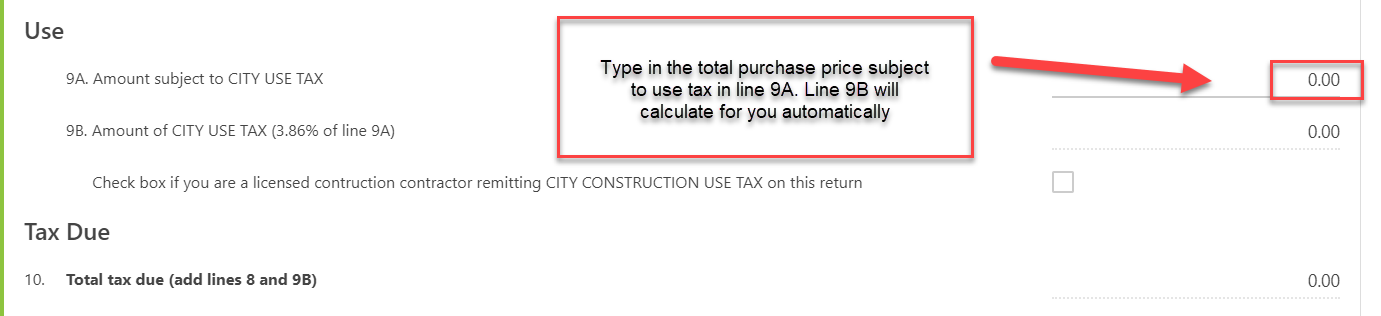

. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. You can get information on a Colorado sales tax license by following the link provided. Use Boulder Online Tax System to file a return and pay any tax due.

Creating a User is secure and easy-. The process of applying for. Castle Rock CO 80104.

FinanceSales Tax Licensing 303 335-4524. Submit Payment with your tax filing. Where do I file my Sales Tax Returns.

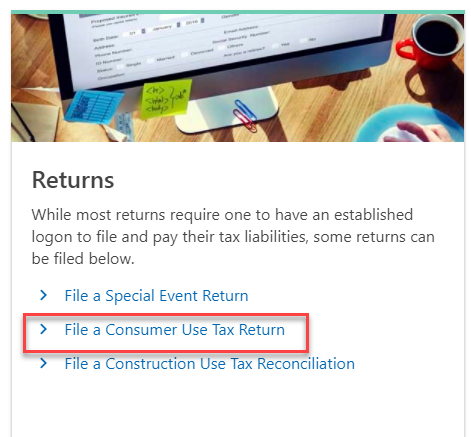

Boulder Online Tax System. Senior Tax Worker Program. There are a few ways to e-file sales tax returns.

Sales tax returns may be filed annually. You must register your business with the City of Evans and the Colorado Department of Revenue. File Sales Tax Online.

Detailed information on Sales Cigarette and Tobacco and Accommodations Tax can be found in the Town of Avon Municipal Code Chapters 308 310 and 328 respectively. Businesses register with CDOR to determine what taxes to pay. Boulder County has one of the highest median property taxes in the United States and is ranked 437th of the 3143 counties in.

The Boulder sales tax rate is. You may apply for a Use Tax Refund for the amount of any sales tax paid on building materials purchased for that specific construction project. The County sales tax rate is.

Starting January 1 2017 returns submitted on paper are subject to a 500 paper filing fee. To start the blank utilize the Fill Sign Online button or tick the preview image of the document. You can print a 8845 sales tax table here.

The median property tax in Boulder County Colorado is 2014 per year for a home worth the median value of 353300. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. If you need additional assistance please call 303-441-3050 or e-mail us at.

Please remit the City of Evans sales and use tax to. Sales Tax Division PO Box 912324. To remit your sales tax by mail.

Visit the Boulder Online Tax System Help Center for additional resources and guidance. This is the total of state county and city sales tax rates. Navigating the Boulder Online Tax System.

FinanceSales Tax Licensing 303 335-4570. For tax rates in other cities see Colorado sales taxes by city and county. Once you have registered your business a City of Evans business license and tax return will be mailed to you.

The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans. The advanced tools of the editor will lead you through the editable PDF template. They should be remitted to the State of Colorado.

Phone and web support at 1-888-751-1911. Annual returns are due January 20. Brighton CO 80601 Phone.

The City of Cortez has implemented mandatory on-line registration for new sales tax licenses and also for the filing and remittance of sales tax returns. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. All State County and Special District Summit Combined Housing Authority taxes should be remitted to the Colorado Department of Revenue on a State sales tax return form.

MUNIRevs provides phone and web support Monday-Friday from 8am to 5pm. FinanceSales Tax Licensing 303 335-4514. Submit Sales Tax Filing across Jurisdictions.

The Senior Tax Worker Program allows senior taxpayers. The Colorado sales tax rate is currently. Online payments available for business license renewal sales and use tax return Customers are now able to pay online at.

Print records of your previous filings. The minimum combined 2022 sales tax rate for Boulder Colorado is. Questions may be directed to 970 748-4046 or by email.

Sales Use Tax Applications Packets. 102 E Parmenter St. The Use Tax is charged at 3 of 50 of the valuation of residential construction.

Create a User Account. Sales tax is due on all retail transactions in addition to any applicable city and state taxes. Contact support if you are having trouble accessing your account applying for a license filing tax forms making payments or if you want to close your account.

Sales tax returns may be filed quarterly. If you have more than one business location you must file a separate return in Revenue Online for each location. Applying for a New License.

If you cant find what youre looking for online contact Sales Tax staff at salestaxbouldercoloradogov. 15 or less per month. 1800 Harlan Street Suite C Edgewater CO 80214.

Online Sales Tax Filing. Boulder County collects on average 057 of a propertys assessed fair market value as property tax. Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020.

The City of Evans self collects local sales tax. Enter your official contact and identification details. Tips on how to fill out the City of boulder sales tax returns on the web.

Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR. Information about City of Boulder Sales and Use Tax. Follow the New User Registration button.

Please do not send your state county or special district payments or returns to the City of Edgewater. The SUTS portal will allow you to. Manage one or many Businesses.

Under 300 per month. Business owners must obtain a Town of Breckenridge Business License in order to engage in business in the Town of Breckenridge please refer to Chapter 1 of Title 3 of the Breckenridge Town Code. Colorado Department of Revenue.

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

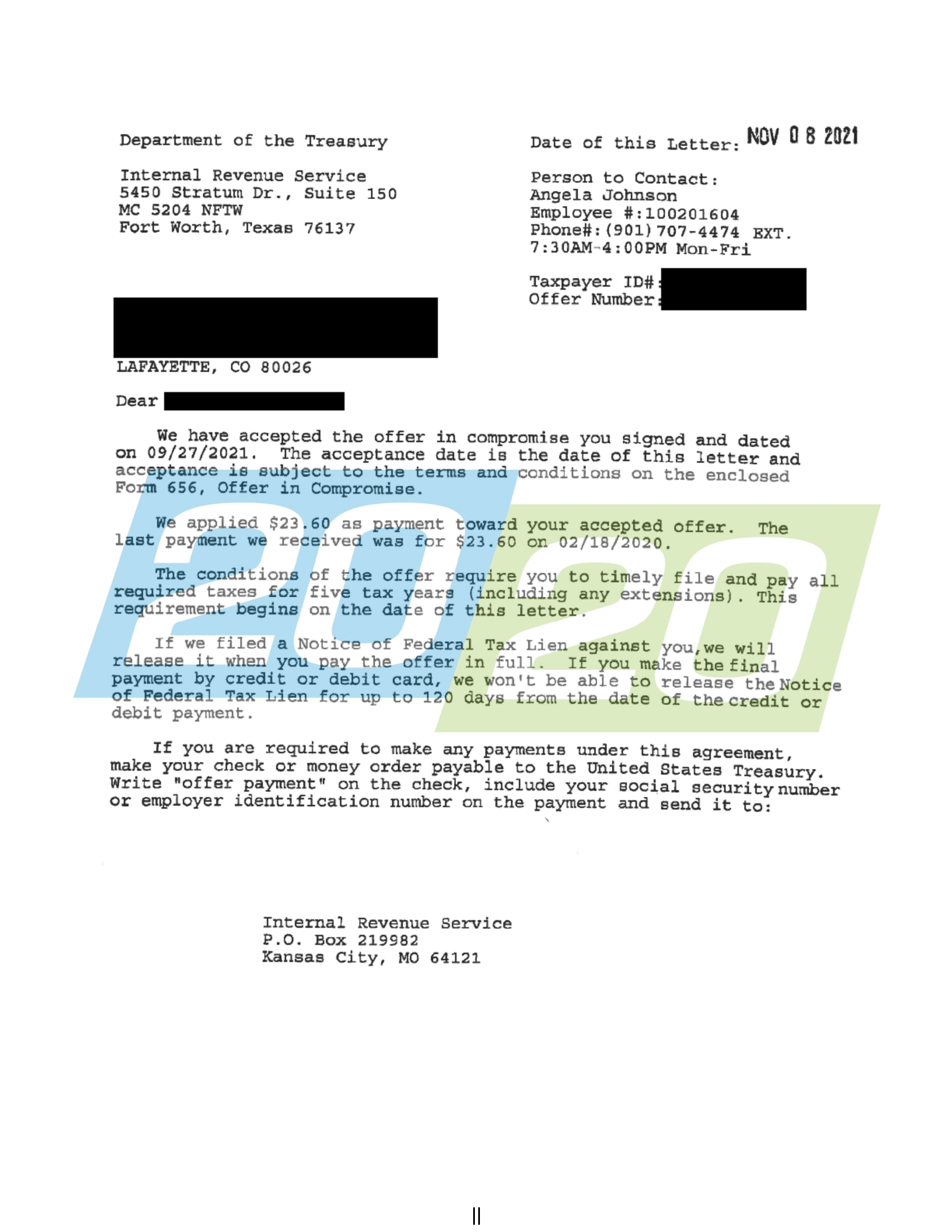

Tax Resolutions In Colorado 20 20 Tax Resolution

Can T Decide What To Do With Your Tax Refund Split It The Denver Post

Is Shipping Taxable In Colorado Taxjar

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax Claim Tax Schedule Account Financial Literacy Lessons Teaching Money Teaching Economics

Sales Use Tax System Suts Department Of Revenue Taxation

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales And Use Tax City Of Boulder

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

File Sales Tax Online Department Of Revenue Taxation

Tax Deadline Colorado Department Of Revenue Extends Income Tax Payment And Filing Deadline For Much Needed Relief