capital gains tax increase 2021 uk

Capital gains taxes on assets held for a year or less correspond to. Capital gains tax rates for 2022-23 and 2021-22.

Https Thebla Co Uk Key Facts About Tax For Furnished Holiday Lettings Owners Landlords Landlord Prs Letting Being A Landlord Let It Be Capital Gains Tax

Well pair you with a certified accountant who can chat through your questions and options.

. There is currently a bill that if passed would increase the capital gains tax in. Will capital gains tax increase at Budget 2021. With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Jun 21 2021 0.

Long-Term Capital Gains Taxes. Many speculate that he will increase the rates of capital. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax. This is called entrepreneurs relief. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019.

Implications for business owners. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Following Uncle Sam and What It Means for UK Entrepreneurs.

This could result in a significant increase in CGT rates if this recommendation is implemented. Hawaiis capital gains tax rate is 725. What the property tax.

Proposed changes to Capital Gains Tax. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. Note that short-term capital gains taxes are even higher.

If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. Theodore Lowe Ap 867-859 Sit Rd Azusa New York. Continued talk of a capital gains tax CGT reform in the UK has been widespread and resounding for some time.

The changes in tax rates could be as follows. The Chancellor will announce the next Budget on 3 March 2021. Strict restrictions for unvaccinated come into effect in Greece.

Corporation tax and capital gains tax are central to the governments plan to. Or could the tax rate be retroactively applied to the 202122 tax year. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

Will capital gains tax increase at Budget 2021. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12. The FCAs Consumer Duty regulation is gilding the lily Paradigm.

UK government shelves proposals to increase Capital Gains Tax rate by. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does. That applies to both long- and short-term capital gains.

By Charlie Bradley 0700 Thu Oct 28 2021. Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more. Ad Get Support And Advice From The UKs Leading Independent Holiday Letting Agency.

CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. In the current tax year people can take 12300 before they pay any capital gains free of tax. UK records 44917 new cases.

Capital Gains Tax CGT has been one of the levies discussed.

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

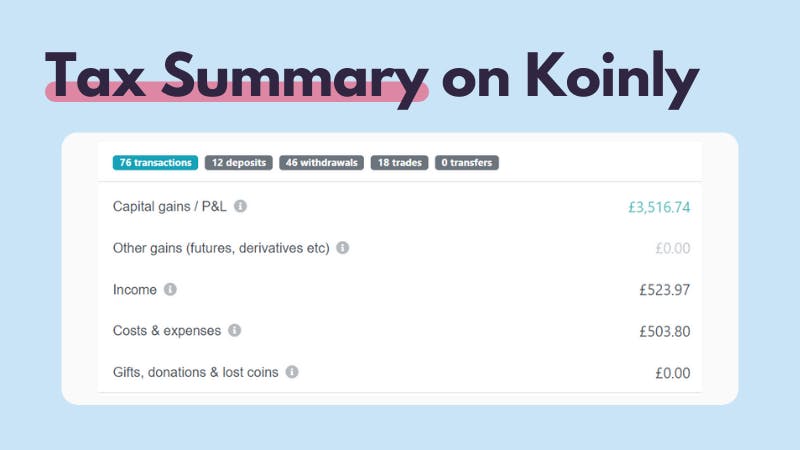

Crypto Tax Uk Ultimate Guide 2022 Koinly

Crypto Tax Uk Ultimate Guide 2022 Koinly

Crypto Tax Uk Ultimate Guide 2022 Koinly

What Are Capital Gains Tax Rates In Uk Taxscouts

U K Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Atk Capital Gains Tax Government Debt The Borrowers

Crypto Tax Uk Ultimate Guide 2022 Koinly

Crypto Tax Uk Ultimate Guide 2022 Koinly

The Age Of Big Data Talent Development Development Education And Training

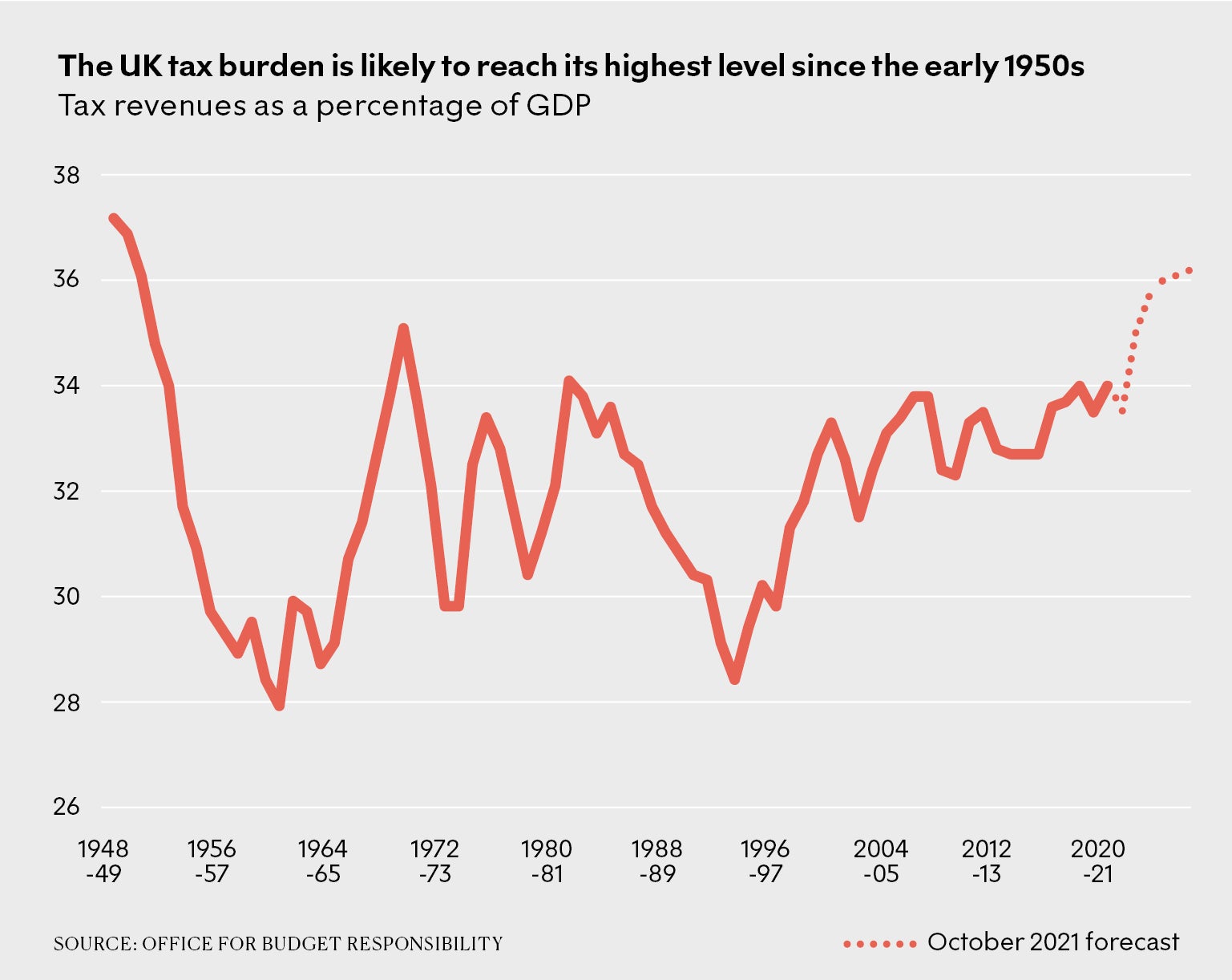

The Rise Of High Tax Britain New Statesman

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Millionaires Petition Rishi Sunak To Introduce Wealth Tax The Super Rich The Guardian

Crypto Tax Uk Ultimate Guide 2022 Koinly

The Complete Guide To The Uk Tax System Expatica

Tax On Test Do Britons Pay More Than Most Tax The Guardian

Crypto Tax Uk Ultimate Guide 2022 Koinly

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Uk S Patriotic Millionaires Call For Higher Taxes On Themselves Marketplace